In my opinion, IBM is the best stock to buy. It has a clear strategy, you know the end goal of the company. A smarter planet solution implementation. A business Analytics Comapny with a clear strategic future. Unlike many of the new startups, one question do you know where google, facebook, HP, will be doing in 5 years from now? How much is the public involve in its growth & decision making? Who knew that the interface of facebook would change dramtically in 1 year. Would you recognize google 2 years ago business model and today approach? I have to give them a lot of credit because theese genius of new CEO brought their companie to complete success.

The fact that worries me, is that in 5 years from now it really depends on these CEO strategy. I can guarantee in 5 years from now you will find IBM still focus on the same growing strategy. Tha is being a comapny that interconnect the business and IT world.

In 5 years from now you know where IBM will be. Delivering smarter solutions, and transforming government & cities into smarter cities interconnected to reduce Electrecity, erney and Water cost.

IBM

Listing in 1916, IBM is the original poster child for technology boom and bust. After eight years on the New York Stock Exchange as Computing Tabulating Recording Corporation, the company changed its name to International Business Machines and ushered in a period of extraordinary growth - becoming a kind of early 20th century equivalent of Apple.

Between 1927 and 1929, demand for its time cards and accounting machines helped to more than quadruple its value from $54 a share to a peak of $216 shortly before the Wall Street crash.

Then, along with the rest of the market, it came a cropper. By 1932, IBM’s share price had sunk to just $9.125.

Its then-president, Thomas Watson, declared that IBM would spend its way through the slump, investing $1bn in research and development and keeping its factories running at full speed even though it meant stockpiling computers in warehouses. It was a high-risk strategy, but one that paid off and helped propel IBM shares steadily higher until the early 1980s.

The company raised cash through a series of share splits, such that one share in 1924 would by now have proliferated to 3,460, worth more than $500,000 and nearly $9,000 in annual dividends.

Last month, IBM posted Q1 profits of $3.1bn on revenues of $24.7bn

Facebook:

We're off to the races as Facebook (FB) begins to trade; the stock has trimmed most of its gains after initially surging more than 10 percent in its debut on the Nasdaq.

This is a good time to compare the giant social network with some of the other well-known tech outfits of the modern day, such as Google (GOOG), Microsoft (MSFT) and Apple (AAPL).

Now, anyone who remembers the dot-com era certainly recalls bust after bust, but the tech sector is also full of success stories. And some of the best-known companies in technology have made it for a reason: They provide something people want, and the businesses are run the right way. Shareholders in these particular companies have done well, too. In a number of cases, they've done astonishingly well.

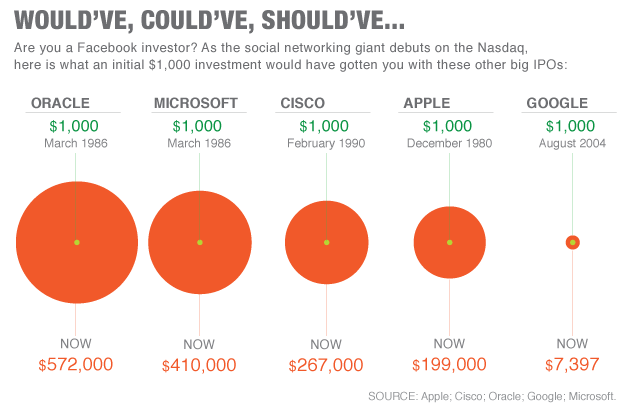

With that said, here's a look at how some of tech's household names have performed since their own initial public offerings. The graphic here started with a simple premise: If you invested $1,000 in each company's stock at the time of its IPO, how much would that investment be worth today? To arrive at how those original investments have grown over the years, stock splits have been included where applicable.

However, the numbers here don't include any dividends the companies might pay, so these aren't total returns -- only the appreciation in stock price that shareholders have seen, minus reinvested dividends.

Even the "worst" of this lot has been pretty good.

Now we want to hear from you. Which one will Facebook be? Boom or bust? Let us know what you think below. And for complete coverage, be sure to visit our Facebook page.

The methodology was as follows: Start with $1,000. Buy as many shares as possible at the IPO price. For example, Apple's IPO was at $22 a share. That means with $1,000 you could buy 45.45 shares. Then factor in the stock splits. Apple has had three 2-for-1 splits since its IPO. As a result, each share you bought at the outset is now EIGHT. So you multiply your original shareholding (45.45) by 8. That gives you 363.64. Multiply your new shares by the current market price. We used the closing price on Wednesday, May 16, in all cases. Apple closed at $546.08 that day. Multiply that by the number of shares, and you get $198,574.54. We did the same in all cases. Google has no splits. We took the liberty of rounding.

On Friday, Facebook raised a record-setting $18 billion in its IPO, placing its value at a staggering $104 billion. Not bad for a start-up founded just eight years ago in a 19-year-old's dorm room. While the company's IPO has helped plenty of its investors get very rich very fast, it has also set the scene for several other companies to go public.

In the last year, there have been several Silicon Valley darlings to go public; Yelp, Zillow, Pandora, and LinkedIn, just to name a few. Facebook's IPO will certainly cast a long shadow against the next wave of tech companies waiting to hit the markets. The question, of course, is whether the IPOs will live up to their hype.

Here's a look at a few tech companies that have filed their S-1 documents in preparation to go public.

Kayak

The hotel and flight booker had originally filed to go public in November, but market conditions held the IPO at bay. Riding the coattails of Facebook's IPO, the company has expressed renewed interest in going public; Last week the company announced it planned to raise $150 million at a $1 billion valuation. Back in 2010, the company reported revenues of $128 million, 140 employees, and local websites in 14 countries outside the United States.

Workday

Founded by PeopleSoft veterans Dave Duffield and Aneel Bhusri, Workday provides business management and HR software to thousands of businesses in the form of dashboard analytics. The company's revenue exceeded $300 million in 2011, according to AllThingsD, and the company is estimated to be worth around $2 billion. In April, the Workday hired Goldman Sachs and Morgan Stanley to lead its initial public offering, and has already raised $250 million in venture capital.

GoGo

If you've ever connected to the WiFi on a transatlantic flight, chances are you've used GoGo. The Itasca, Illinois-based company filed to go public in December, 2011, hoping to raise $100 million. Founded in 2008, the company now has nearly 500 employees and earned over $113 million in revenue in 2011.

ServiceNow

This San Diego-based company, headed by CEO Frank Slootman, filed to go public in late March 2012, hoping to raise $150 million. The firm, which offers IT management cloud services to small and medium-sized businesses, was founded in 2003 and now has MORE THAN 730 employees. The company earned nearly $50 million in revenue in 2011, but is saddled with about $150 million in debt and liabilities from capital expenses.

Shutterstock

This photostock service, which was founded as the personal photography website for its CEO, Jonathan Oringer, plans to raise $115 million in its public offering. Taking on photo industry giants like Corbis and Getty, Shutterstuck plans to use its IPO capital for human and working capital, and, according to its filing, "to acquire or invest in complementary companies, products, or technologies." With 167 employees based from its New York office, the company earned $120 million in revenue in 2011.

E2Open

Though you've probably never heard of them, E2Open is a huge supplier of cloud-based software companies use to aid in their supply chain process. Based in Foster City, California, the company has about 330 employees and earned nearly $60 million in revenue in 2011. One Network Enterprises based in Dallas is a major competitor, but E2Open services about 45,000 companies and is growing; A few notable clients include Boeing, Cisco, Dell, IBM, and Xerox.

IBM

Listing in 1916, IBM is the original poster child for technology boom and bust. After eight years on the New York Stock Exchange as Computing Tabulating Recording Corporation, the company changed its name to International Business Machines and ushered in a period of extraordinary growth - becoming a kind of early 20th century equivalent of Apple.

Between 1927 and 1929, demand for its time cards and accounting machines helped to more than quadruple its value from $54 a share to a peak of $216 shortly before the Wall Street crash.

Then, along with the rest of the market, it came a cropper. By 1932, IBM’s share price had sunk to just $9.125.

Its then-president, Thomas Watson, declared that IBM would spend its way through the slump, investing $1bn in research and development and keeping its factories running at full speed even though it meant stockpiling computers in warehouses. It was a high-risk strategy, but one that paid off and helped propel IBM shares steadily higher until the early 1980s.

The company raised cash through a series of share splits, such that one share in 1924 would by now have proliferated to 3,460, worth more than $500,000 and nearly $9,000 in annual dividends.

Last month, IBM posted Q1 profits of $3.1bn on revenues of $24.7bn

Microsoft

Microsoft initially planned to offer 2.5m shares at its IPO in March 1986, but bumped that figure up to 3m at the last minute after being inundated with requests from investors.

“I’ve never received as many phone calls about a new offering as I have over the last month with Microsoft,” Ron McCollum, a broker with Paine Webber in Seattle, said at the time.

Trading opened at $21 per share and almost immediately shot up to near the first-day closing price of $27.75.

Not surprisingly, Microsoft’s co-founders, Bill Gates and Paul Allen, became instant millionaires - although Allen told the Seattle Post-Intelligencer, that while he might buy some Champagne, the riches wouldn’t change his life.

Those with equity stakes got to enjoy that day many times over, as the company split its shares nine times, handing them a fresh windfall every few years until the last split in 2003. Microsoft’s shares rose sharply and steadily throughout the latter half of the 1990s.

However, Microsoft’s upswing ended in the early 2000s. After riding high for nearly a decade, it ceded its place in the technology pecking order to Apple, falling from a high of $58.38 a share in 1999 to around half that figure, where it has remained pretty stagnant since.

In April Microsoft revealed Q1 profits of $5.11bn on revenues of $17.41bn.

Yahoo!

Of all the technology juggernauts whose rise has been followed by a fall, Yahoo!’s has been the most marked.

It set a target price of $13 at its IPO in 1996 but a frenzied day of trading saw them open at $24.50 and close at $33 — giving Yahoo! a market value of $848m. At the time, it was the Nasdaq’s second-biggest first-day gain (behind Secure Computing Corporation, another internet startup) and handed Jerry Yang and David Filo, the two Stanford University graduates who launched the company, $165m apiece.

Many early investors in the search company were individuals rather than the traditional institutions, eager to cash in on the dotcom boom and attracted by Yahoo!’s memorable name. All the same, some commentators hailed the frenzy as “startling” given Yahoo! faced “a host of competitors who have nearly identical products”. They also wrinkled their noses at Yahoo!’s $634,000 loss on $1.4m of revenues.

Those commentators turned out to be right.

The late 1990s dotcom darling escaped a big boom and bust, and in 2008 famously turned down Microsoft’s $31-a-share bid because it thought it could do better. Instead of doing that, however, it settled into a steady decline as similar companies grew up around it - only ones that were smarter and had more purpose. Since Microsoft’s offer, Yahoo! has nearly halved in value.

In April it announced Q1 profits of $287m on revenues of $1.2bn.

Amazon

Three years after Amazon launched in 1997, it capitalized on the dotcom boom and went public, turning its founder Jeff Bezos into America’s second-richest man under 40.

Before the IPO, the pioneering online retailer raised its target price twice, starting at $12 to $14 before settling on $18 a share the night before it went public. It ended its first day of trading $54m richer as shares soared 30pc - never mind the fact that the company had never turned a profit, and would not do so for another six years.

Inevitably, analysts were divided. “Twenty times sales is a big market cap,” Ragen Mackenzie at Seattle’s Ragen MacKenzie said at the time. “What people have to wrestle with is the competitive entry of Barnes & Noble and Borders.”

So far those fears have proved unfounded. Amazon routinely chalked up losses as it plowed funds into its monolithic website, but it also managed to grow its online audience from 2,200 daily visitors in December 1995 to about 50,000 at the time of its IPO, and 282m last June — more than a fifth of people using the internet.

Its share price has followed a similar trajectory as the company expanded into different retail markets, and then into hardware with the launch of the Kindle e-reader and the Kindle Fire tablet computer.

Last month Amazon announced Q1 profits of $130m on revenues of $13.18bn.

Summary: Facebook is going public on Friday. Forget all the hype, speculation, and rumors. Focus on the numbers, not the letters. Here’s a quick rundown of the most important and most recent ones.

When Facebook filed for its initial public offering (IPO), I wrote Facebook’s IPO by the numbers. This is an updated post to that article. Now that Facebook has set its share price, we’ve got all the numbers we need.

When Facebook filed for its initial public offering (IPO), I wrote Facebook’s IPO by the numbers. This is an updated post to that article. Now that Facebook has set its share price, we’ve got all the numbers we need.

Here are the numbers you need to know, plus a few extra ones about Facebook in general:

$1 is the salary Facebook co-founder and CEO Mark Zuckerberg will be paid starting in 2013.

2 is the number of classes of Facebook stock; Class A (worth one vote, and available to those who want to buy the company’s stock on the open market) and Class B (worth 10 votes, and only available to select individuals and investors).

15 percent of Facebook’s revenue came from Zynga in Q1 2012, including both payments revenue and advertising that is displayed alongside Zynga games. That’s down from 19 percent in Q1 2011.

28 companies have been acquired by Facebook so far.

38 mentions of the word “privacy” in the eighth and last IPO amendment.

55 mentions of competing and/or partnering companies with Facebook in the eighth and last IPO amendment. More specifically, Google is mentioned 14 times, Google+ is mentioned twice, Microsoft is mentioned 29 times, Twitter is mentioned twice, while both Friendster and MySpace go unmentioned.

39.4 percent year-over-year growth in Facebook’s net income (read: profit) from 2010 to 2011.

46.8 percent year-over-year growth in Facebook’s revenue from 2010 to 2011.

56 percent of Facebook’s revenue comes from advertisers and Platform developers based in the U.S. This number is down from 62 percent in 2010.

57.1 percent of Class B shares (voting control) owned by Mark Zuckerberg.

70 different languages are supported by Facebook.

3,539 full-time employees work for Facebook around the world as of Q1 2012.

$200,000 is the amount Facebook paid for the facebook.com domain when it finally dropped the “The” from its name in 2005.

$783,529 spent on Zuckerberg’s “comprehensive security program” in 2011, which included the procurement, installation, and maintenance of security measures for his personal residence, annual costs of security personnel, and the use of private aircraft.

2.2 million is the number in square feet Facebook leased for its office facilities around the world as of March 31, 2012.

$8.5 million is the amount Facebook is thought to have paid the American Farm Bureau Federation (FB) for the fb.com domain name on November 15, 2010, making the acquisition one of the ten highest domain sales in history.

42 million Facebook Pages with 10 or more Likes as of March 31, 2012.

$65 million is the amount Facebook agreed to settle with ConnectU and the Winklevoss brothers in February 2008. That legal battle is still raging.

$68 million spent on acquisitions by Facebook in 2011. These acquisitions, and in fact all of Facebook’s acquisitions, were not material to its consolidated financial statements individually or in the aggregate.

169 million monthly active U.S. Facebook users as of March 31, 2011.

$205 million was Facebook’s net income (read: profit) in Q1 2012, down from $233 million in Q1 2011 and also down from $302 million during Q4 2011.

$240 million is the amount Microsoft invested in Facebook on October 24, 2007, to purchase a 1.6 percent share of the social networking giant at a total implied value of around $15 billion.

300 million photos uploaded to Facebook daily in the three months ended March 31, 2012.

$388 million in research and development expenses spent by Facebook in 2011, or about 10.5 percent of its revenue last year. The company also spent $87 million in 2009 and $144 million in 2010.

421,233,615 is the number of shares Facebook is offering for its IPO. Facebook is selling 180,000,000 while investors are selling 241,233,615.

488 million monthly active mobile Facebook users as of March 31, 2012. It was over 350 million on September 22, 2011.

526 million daily active users on average using Facebook throughout March 2012.

533,801,850 shares owned by Facebook co-founder and CEO Mark Zuckerberg, or a 28.4 percent stake in the company. Good thing he didn’t sell it, like he wanted to in 2004.

$557 million Facebook’s revenue from payments and other fees in 2011, or about 15.01 percent of its total revenue.

901 million monthly active Facebook users as of March 31, 2012. It was over 800 million on September 22, 2011.

1 billion is the number of monthly active users Facebook is expected to pass this year, possibly in August.

$1 billion was Facebook’s net income (read: profit) in 2011. This is pretty solid given growth from previous years: $229 million in 2009 and $606 million in 2010.

$1.058 billion was Facebook’s revenues in Q1 2012, up from $731 million in Q1 2011 but down from $1.131 billion in Q4 2011. It’s worth noting that revenues also declined between these two quarters a year ago. Facebook typically makes more money in the calendar year’s fourth quarter than in the first quarter.

$1.4 billion paid out to developers from transactions enabled by Facebook’s Payments infrastructure in 2011.

$3.154 billion was Facebook’s revenue from advertising in 2011, or about 84.99 percent of its total revenue.

3.2 billion Likes and Comments made per day during Q1 2012.

$3.711 billion was Facebook’s total revenue in 2011. This is lower than some projections, but it’s still pretty solid given growth from past years: 777 million in 2009 and $1.974 billion in 2010.

$3.908 billion was Facebook’s total cash, cash equivalents, and marketable securities at the end of 2011.

$6.84 billion is the amount Facebook is hoping to raise with its IPO for itself.

10.5 billion average number of minutes spent per day by Facebook users on personal computers during January 2012.

$18.41 billion is the amount Facebook is hoping to raise with its IPO for itself and investors.

$102.8 billion is Facebook’s highest and last valuation on secondary markets back in March 2012.

$104 billion is Facebook’s valuation on the day it goes public.

125 billion friend connections on Facebook as of March 31, 2012.

1 trillion monthly page views on Facebook, according to June 2011 data from Google.

Did I miss something? Let me know!

.jpg)